James Fisher's tax strategy

Published in accordance with Para16(2) Schedule 19 Finance Act 2016 this represents the Group’s tax strategy in effect for the year ending 31 December 2023.

James Fisher and Sons plc (James Fisher) operates in a number of jurisdictions and is a leading service provider to all sectors of the global marine industry and a specialist supplier of engineering services to the energy industry.

James Fisher is committed to managing its tax affairs in a responsible and transparent manner, to comply with all relevant tax legislation and to have due regard for the Group’s wider reputation and its corporate social responsibilities. Whilst the Group has a duty to shareholders to seek to minimise its tax burden, its policy is to do so in a manner which is consistent with its commercial objectives, meets its legal obligations and its code of ethics.

James Fisher considers that financial crime is unacceptable and it does not tolerate criminal tax evasion, nor deliberate or dishonest facilitation of another party’s tax evasion carried out by anyone acting on the Group’s behalf. It is our policy to refuse to transact business with parties who we consider may be engaging in tax evasion.

The Group aims to manage its tax affairs with regard for the intention of the legislation rather than just the wording itself. Our tax objectives are to comply with all applicable tax laws and regulations, including the timely submission of all tax returns and tax payments and to undertake all dealings with local tax authorities in a professional and timely manner. Substantial tax revenues (including payroll taxes) are generated by the Group’s operations worldwide.

The Board has ultimate responsibility for tax governance. Executive responsibility rests with the Group Finance Director who reports to the Board as required.

The Group has a dedicated in-house tax function that deals with the Group’s day to day tax management issues and with UK corporation tax compliance. External tax agents are appointed to deal with corporate income tax compliance in foreign tax jurisdictions.

Certain tax responsibilities (e.g. VAT) are devolved to individual business units. These units are required to comply with Group policies and financial controls and certify compliance to the Group Finance Director.

The tax strategy is communicated to personnel within the business who play a part in the delivery of the strategy. Supervision, training and guidance is provided to staff who have tax related responsibilities.

If matters of uncertainty arise in relation to the application of tax law the approach is to seek to resolve that by taking external professional advice or dialogue with the relevant tax authority.

External professional tax advice is obtained in areas and geographies where additional expertise is required in order to comply with legislation and ensure taxes are correctly computed and paid. James Fisher also holds regular meetings with its tax advisers, the Group tax function and Business Finance Directors to discuss key risks and issues for the Group.

Risk appetite is not defined in numerical terms. In view of the policy objective to be tax compliant and the limitations on tax planning described below James Fisher considers that it has a low tax risk appetite.

The Group has obligations to shareholders and thus the tax strategy does not rule out legitimate tax planning. Planning opportunities that are regarded as consistent with commercial objectives and which are likely to benefit shareholders may be considered. Opportunities may be pursued provided they do not represent a serious threat to the Group’s reputation nor must they damage relations with regulatory authorities. It is Group policy not to undertake any tax planning transaction that would reflect adversely on James Fisher. The Group’s tax advisers are asked to review, advise on and approve any significant tax planning measures. The Group’s policy is not to seek to take advantage of arrangements which are intended to give rise to tax effects substantially inconsistent with the economic substance.

We seek to maintain a good working relationship with tax authorities and deal with them in an open, transparent and timely manner. All reasonable cooperation will be given in relation to audits and enquires.

This strategy was approved by the James Fisher Board on 9 November 2023 and will be reviewed annually.

James Fisher's governance

Sign up to regulatory news services (RNS) alerts from James Fisher and Sons plc (LSE: FSJ).

Our latest news

Discover the latest stories from across James Fisher

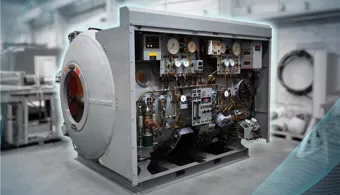

Local jobs boost as JFD Australia's East Coast expansion continues

Read article

JFD secures £11m service contract with UK MoD ensuring long-term operational availability of their subsea capabilities

Read article

Rt Hon Ian Murray MP, Secretary of State for Scotland visits the new home of the NATO Submarine Rescue System

Read article

JFD Australia continues to expand its defence industry presence

Read article

Australia's submarine rescue system in safe hands as JFD Australia locks in contract extension

Read article

James Fisher strengthens APAC commitment with Japan entity

Read article

James Fisher to enhance its fleet of the future with four new state-of-the-art tanker vessels

Read article

JFD successfully mobilises NATO Submarine Rescue System during Dynamic Monarch exercise

Read article

Annual Report 2024

Annual Report 2024